Developer Documentation

The developer documentation below provides introductory details on how to integrate your Mobile APP or Website into our MultiPay Payment Service.

Getting Started

The MultiPay APIs are REST based and communication is conducted over a HTTPS connection using TLS v1.2.

Your API Subscription Key must be specified in each request using the Ocp-Apim-Subscription-Key header and the request body should be in the format of application/json.

The results of many of the API requests are asynchronous meaning that you are required to provide a callback URL in the request where the response of the request is sent to.

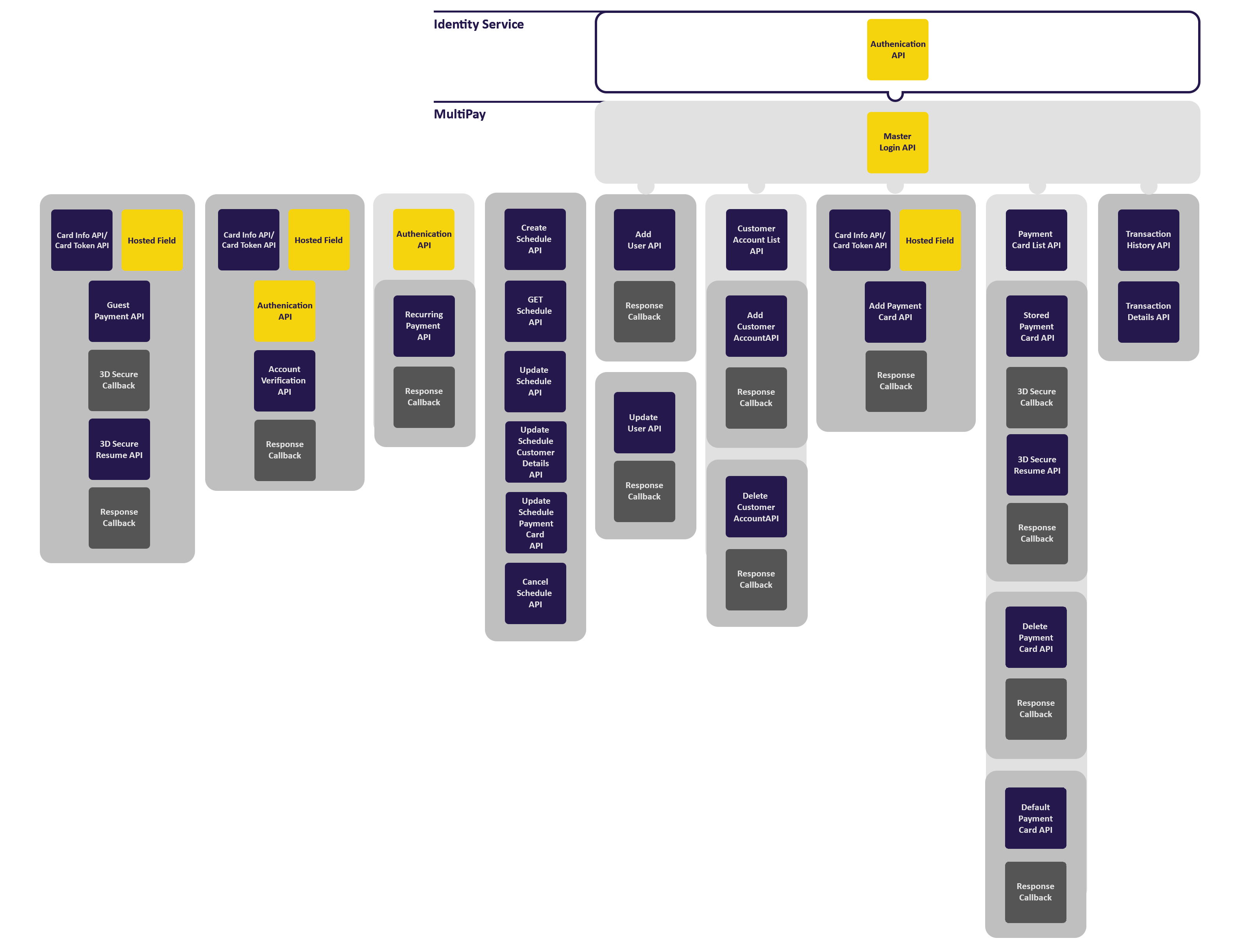

The MultiPay APIs are broken down into seven main service sections ( Payment Requests, Recurring Scheduled Payments, Customer Authentication including updating customer balance, Customer Management, Payment Card Management, Payment Scheduler and Transaction History ) each with their own process flow.

The diagram below shows how each of the MultiPay APIs work together to perform the required service, click on the image to enlarge.

Payment Card Tokenisation

To create a Payment Request we require for the credit/debit card number to be tokenised, thus removing additional demands on becoming PCI DSS compliant.

The card token is stored with a limited lifespan for Guest Payment and Add Payment Card Requests.

Building a Native Mobile APP - API

To create a card token you will need to make two POST requests as detailed below:

Card Info

The initial CardInfo Request is a POST request containing the cardholder’s PAN. We then perform a BIN lookup and check that it is a valid card before returning synchronously the result of the lookup including details the Card Scheme and Card Type. Only valid cardholder’s PAN will be processed and therefore require tokenisation.

To make a CardInfo Request POST the following Payload to: https://sandbox.multipay.uk/PP.SmartPay.PaymentCard.Api/PaymentCard/CardInfo

{"pan":"9900000000005159"}

Card Token

The CardToken Request is a POST request containing the cardholder’s valid PAN. We then encrypt the cardholder’s PAN and generate a Token which is then synchronously returned as the response of the request.

To make a CardToken Request POST the following Payload to: https://sandbox.multipay.uk/PP.SmartPay.PaymentCard.Api/PaymentCard/CardToken

{"pan":"9900000000005159"}

Important: In order to make a successful POST call to both Card Info and Card Token endpoints you are required to provide the SandBox API User Key called (Ocp-Apim-Subscription-Key) in the request header.

Note: The Production Card Info & Card Token URL reside on an external PCI DSS server therefore are different to the SandBox URLs above.

Building a Website - Hosted Field

The MultiPay Hosted Field solution allows your customers to submit online Guest Payments or Add Payment Card requests from your website without the complexity of you becoming PCI DSS complaint.

The MultiPay Hosted Field solution renders the sensitive Credit/Debit Card Number input field into your website using an iframe that is hosted by PayPoint in our PCI DSS compliant zone.

The cardholder simply completes the Card Number (PAN) input field on our server, we then encrypt the cardholder’s PAN and generate a Token which is then returned back to the browser. The Hosted Field solution provides a JavaScript Callback to receive the Card Token along with the Card’s Scheme and Type. The hosted Card Number (PAN) input field can also be easily customised to fit into your payment page design.

To complete a guest payment request your website's payment page needs to collect the Amount, Account Type, Customers Details & Card Detail including the CVV, Expiry Date and combine then with returned Card Token and Card Type before sending the request for authorisation using the Guest Payment API.

For a step by step guide to how to include the Hosted Field to your website's payment page, please refer to Hosted Field.

Payment Requests

Guest Payment

To create a one-time payment (Guest payment) a POST Payment Request is required containing; ClientTransactionRef, Amount, Account Type, Customers Details & Card Detail including the CVV, Expiry Date and the Card Token (as detailed above). The request must also contain the Callback URL allowing for an asynchronous response, meaning that the result of the authorisation is in the Callback and is not in the initial response to the request.

For details on how to make a Guest Payment Request refer to the detailed API Documentation

Stored Payment Card

To create Payment Request using a card that has been previously stored we will require a POST Payment Request containing; ClientTransactionRef, Amount, Account Type, Customers Details & Card Detail including the CVV, Expiry Date and the stored Payment Card ID. The request must also contain the callback URL allowing for asynchronous response meaning that the result of the authorisation in the call and is not the initial response to the request.

For details on how to make a Stored Payment Card Request, refer to the detailed API Documentation

Resume - 3D Secure

Both Guest Payment and Stored Payment Card requests, require the cardholder to be authenticated using 3D Secure; for more details on the 3DS process and how to add cardholder authentication to your payment requests, visit 3d Secure.

As part of the 3DS process you will need to make an additional request to resume the transaction with details on the result of the cardholder authentication, for details on how to make a 3DS Resume Request, refer to the detailed API Documentation

Common Payment Response Codes

SS000 - Payment Successful

ST900 - SmartPay Unavailable - Please try again later

SP100 - Card Declined

SP200 - Declined by Bank

SP201 - Referral to Bank

SP202 - Card reported lost or stolen;

SP203 - The transaction has been blocked

SP204 - Declined Other

ST300 - Invalid content in request

ST301 - Compulsory field not present – cannot continue.

ST108 - Invalid PaRes

SP117 - Card brand is not supported on this account

ST909 - Failure in Vend Activity from Transaction Injector REST

Pay By Bank Transfer

To create a one-time Bank Transfer from the customer's bank account, you need to send a Payment Consent request to the Open Banking PISP. The payment request must contain a callback URL to receive the asynchronous response which includes the redirect URL to the Open Banking Payment Page. To allow the customer to continue to make their Bank Transfer, you will need to display the Open Banking Payment Page. The customer then provides payment consent, authenticates themselves with their selected bank and then authorises the transfer.

For details on how to make a Pay By Bank Transfer Request, refer to the detailed API Documentation

Pay By Bank Resume

To complete an one-time Bank Transfer from the customer's bank account, you need send a Pay by Bank Resume request after you have redirected the customer to the Open Banking Payment Page. The resume request must contain the TransactionId a callback URL to receive the asynchronous response which includes the result of the payment consent and the progress of the Bank Transfer.

For details on how to make a Pay By Bank Resume Request, refer to the detailed API Documentation

Recurring Scheduled Payments

Before initiating a recurring scheduled payment from your customer, you will need to obtain Continuous Authority on the customer’s card. This is achieved by sending an API request containing the customer’s card details for Account Verification.

Account Verification

Account Verification or Zero Auth sends the only card details for verification and is not authorisation of a payment. Upon a successful verification we will store the Credentials on File and have the Continuous Authority for the credentials to be used in subsequent scheduled payments. An asynchronous response containing the result of the request is returned, including a Recurring Payment Card ID for the stored Credentials on File.

For details on how to make an Account Verification request, refer to the detailed API Documentation

Recurring Payment

To request a recurring payment from your customer’s Credentials on File, you will need to send a Payment Request containing your Client Bearer Token obtained when authenticated by the identity service (See Identity Service - Authentication below). The request body must contain the RecurringPaymentCardId, amount and type of recurrence (recurring/instalment). You must also include a Callback URL to receive the asynchronous response containing the result of the recurring payment authorisation.

For details on how to make a Recurring Card Payment, refer to the detailed API Documentation

When managing your own payment schedule you will need to conform with card scheme rules regarding the use the Continuous Authority. For more details on card scheme compliance, please visit: Your Website & Payment Scheme Compliance section.

Customer Authentication

To allow customers to make a Stored Payment Card transaction, view their Transaction History and manage both their Payment Cards & Customer Account it is required that the customer is authenticated. Using a process of Single Sign On (SSO) the following methods allow for the customer to be authenticated and to be automatically logged into the MultiPay Platform.

As the client you will be provided login access to the Identity Service and are required to authenticated before submitted any Master API calls.

Identity Service - Authentication

Before logging in as customer, as the client you will need to logon to the PayPoint identity service by submitting a request containing your username and password. You will then be provided in the response an Authenticated Client Bearer Token which is required to be sent in the following Master API calls:

For details on how to make an Authentication Request to the Identity Service, refer to the detailed API Documentation

Master Add User

If the customer does not exist in the PayPoint Identity Service and MultiPay Platform, you can request to add a new user on both services. To add a customer/user you will need to submit an Master Add User Request containing the Authenticated Clients Bearer Token and the Customer details including: Customer Username (Email Address), First Name, Last Name, Account Type, PRN/PAN, Product Type and Mobile Number.

For details on how to make a Master Add User Request, refer to the detailed API Documentation

Master Login

To login as the customer you will need to submit a Master User Login Request which contains the Authenticated Clients Bearer Token and the Customer Username. You will then be returned a Customer Bearer Token which is required to be sent in the header of the Payment Request, Customer Management, Payment Card Management and Transaction History APIs.

For details on how to make a Master Login Request, refer to the detailed API Documentation

Master Update Account Balance

If enabled, you can POST the account balance of a registered customer by submitting an Master Update Account Balance Request. The request will need to contain your Authenticated Clients Bearer Token, and the customer's balance details including: Customer Account Number (PAN), Balance, Debt Balance (optional) and the UTC time of when the balance was taken.

For details on how to make a Master Update Account Balance Request, refer to the detailed API Documentation

Master Update User

If the customer exists in the PayPoint Identity Service and MultiPay Platform but has the wrong details then you can request to update a user on both services. To update a customer/user you will need to submit an Master Update User Request containing the Customers Bearer Token and the user details that you wish to change: Customer Username (Email Address), First Name, Last Name and Mobile Number.

For details on how to make a Master Update User Request, refer to the detailed API Documentation

Customer Management

To allow you customers to add or delete a customer account (PRN/PAN) to their Multipay Account you will need the following requests:

Customer Account List

To display the customer account(s) (PRN/PAN) allocated to a customer, you will need send a Customer Account List GET Request which contains the Customer's Bearer Token.

A synchronous response containing each of the customer accounts (PRN/PAN) and the type of account is returned.

For details on how to make a Customer Account List GET Request, refer to the detailed API Documentation

Add Customer Account

To add a new customer account to a customer you will need to send a Add Customer Account Request containing; the Customer Bearer Token (obtained from the Master User Login described above) and the new Customer Account ID (PRN/PAN).

An asynchronous response containing the result of the request is returned.

For details on how to make a Add Customer Account Request, refer to the detailed API Documentation

Delete Customer Account

To delete a customer account you will need to send a Delete Customer Account Request containing; the Customer Bearer Token (obtained from the Master User Login described above) and the Customer Account ID (PRN/PAN).

An asynchronous response containing the result of the request is returned.

For details on how to make a Delete Customer Account Request, refer to the detailed API Documentation

Payment Card Management

To allow you customers to add, delete and default a credit/debit card to their PCI DSS Multipay Account, you will need the following requests:

Payment Card List

To create a stored Payment Card Request you must display a list of the stored payment cards and allow the customer to select their preferred card. To display the payment cards that have been stored you will need send a Payment Card List GET Request which contains the Customer Bearer Token.

A synchronous response containing the stored Payment Card Id, Card Type and Card Scheme for each card that is returned.

For details on how to make a Payment Card List GET Request, refer to the detailed API Documentation

Add Payment Card

To add a new payment card to the customer’s account, you must first get the payment card’s PAN tokenised using the CardToken API or Hosted Field solution described above. When you have a card token you will need to create an Add Payment Request which contains the Card Token, CVV, Expiry Date and the cardholder name.

An asynchronous response containing the result of the request and the stored Payment Card Id is returned.

For details on how to make a Add Payment Card Request, refer to the detailed API Documentation

Delete Payment Card

To delete a Payment Card a Delete Payment Card Request is required containing; the Customer Bearer Token (obtained from the Master User Login described above) and the stored Payment Card Id.

An asynchronous response containing the result of the request is returned.

For details on how to make a Delete Payment Card Request, refer to the detailed API Documentation

Default Payment Card

To default a Payment Card a default Payment Card Request is required containing; the Customer Bearer Token (obtained from the Master User Login described above) and the stored Payment Card Id.

An asynchronous response containing the result of the request is returned.

For details on how to make a Default Payment Card Request, refer to the detailed API Documentation

Payment Scheduler

The following APIs allow you to create and manage recurring payment schedules held with PayPoint. PayPoint will then automatically request each payment from the agreed payment schedule.

Create Schedule

To create a payment schedule, you will need to send a Create Schedule API Request containing: Amount, CustomerId/PRN/PAN, Customers email, Schedule Type, Schedule interval/Recurrence and Start date.

For details on how to make a Create Schedule Request, refer to the detailed API Documentation

Cancel Schedule

To cancel a schedule, you will need to send a Cancel Schedule Request containing the Schedule Id that you wish to cancel. A synchronous response containing the result of the request is returned and if successful the schedule will be flagged as cancelled.

For details on how to make a Cancel Schedule Request, refer to the detailed API Documentation

GET Schedule

To get a list of all the schedules made within a given criteria you will need to send a GET Schedule. A synchronous response is returned which lists each of the schedule including the details: schedule id, amounts, schedule start date, next payment date and the status of the schedule.

For details on how to make a GET Schedule Request, refer to the detailed API Documentation

Update Schedule Customer Details

To update the customer detail in the payment schedule you will need to send a Update Schedule Customer Details API containing the details of the changes.

For details on how to make a Update Schedule Customer Details Request, refer to the detailed API Documentation

Update Schedule Details

To update the schedule interval, recurrence and amount detail in the payment schedule you will need to send a Update Schedule Details API containing the details of the changes.

For details on how to make a Update Schedule Details Request, refer to the detailed API Documentation

Update Schedule Payment Card

To update the credit/debit card used in the payment schedule you will need to send a Update Schedule Payment Card API containing the new Recurring Card Payment ID.

For details on how to make a Update Schedule Details Request, refer to the detailed API Documentation

Transaction History

To display in your online portal or App the transactions that a customers has made, you will need to request the transaction history and details, using the following GET requests:

Transaction History

To get a list of all the transactions made within a given criteria you will need to send a Transaction History GET Request that contains the Customer's Bearer Token and pagination criteria (page number and page size).

A synchronous response is returned which lists each of the transaction within the request criteria and includes the transaction details: transaction id, amounts, service/product and the date of the transaction.

For details on how to make a Transaction History GET Request, refer to the detailed API Documentation

Transaction Details

To receive more details on an individual transaction, send a Transaction Details GET Request that contains the Customer's Bearer Token and the Transaction ID.

A synchronous response is returned containing the transaction’s details amount, service/product, transaction date, truncated payment card PAN and Vend Reference UTRN.

For details on how to make a Transaction Details GET Request, refer to the detailed API Documentation